All major automakers have released their sales data for the month of October 2023, and we have compiled them all for you here.

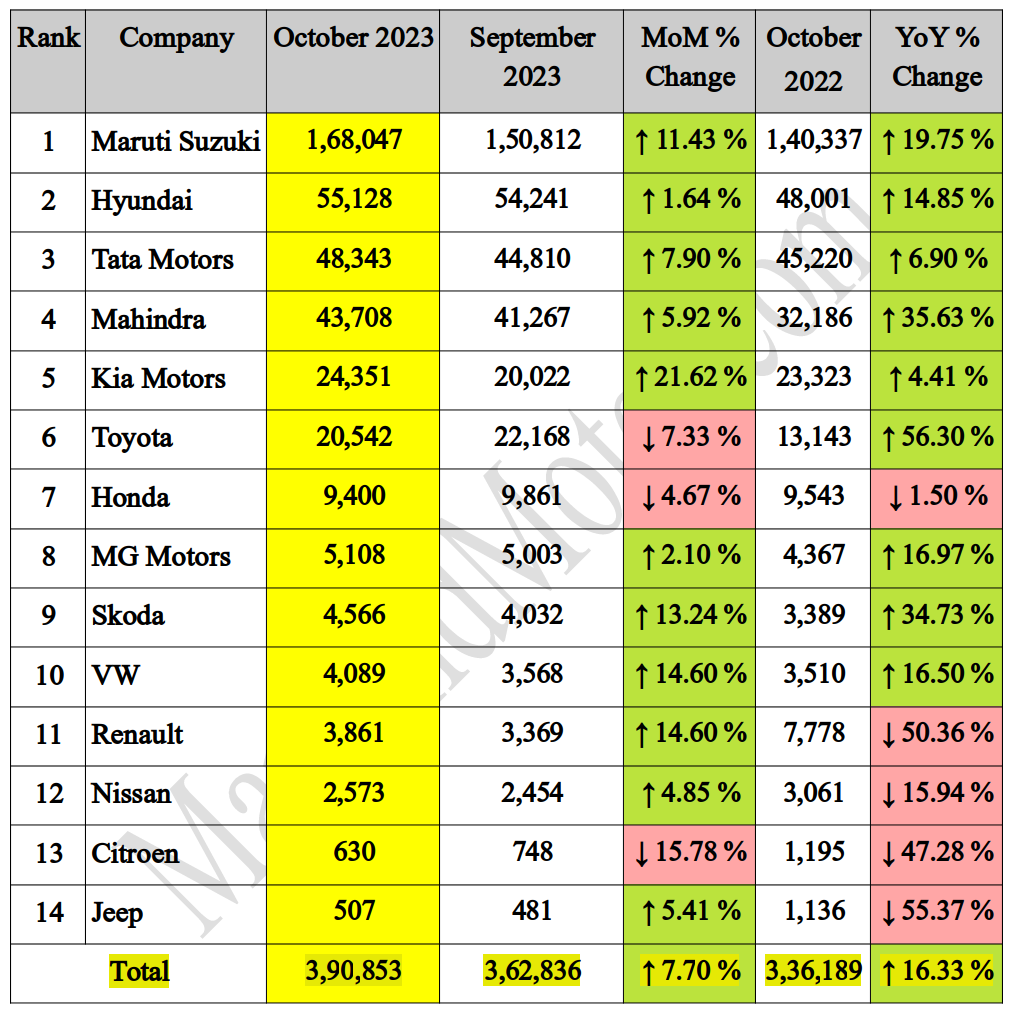

In the month of October, the total domestic sales were 3,90,853 units, which is 16 percent higher than the same month last year. On the other hand, if we compare the October 2023 figures with the September 2023 statistics, the growth is about 7.7 percent. October 2023 was just 9k units short of 4 lakh units to be dispatched in a single month in the automotive history of India. October is the fourth consecutive month with wholesales of 350,000 or more and the tenth consecutive month where passenger vehicle figures have surpassed 3,25,000 units.

The ongoing festive season has boosted footfall in showrooms, and thus, such big numbers are reported. SUV demand has also become an important factor in the sales growth of those manufacturers whose portfolio offers a wide range of SUVs. In the month of October 2023, manufacturers like Suzuki and Mahindra registered all-time high dispatches, and hopes are high for the year-end as well.

Here is the OEM-wise passenger vehicle data for the month of October 2023:

Maruti Suzuki

Maruti Suzuki is known for its value offering in the small car segment, but the SUV craze has changed the philosophy of the leading automaker in the Indian market. India’s number one car maker is consistently losing ground in the mini segment, but on the other hand, its large cars are becoming more and more popular.

In October 2023, Maruti Suzuki India Limited sold a total of 199,217 units, which is its highest ever monthly sales volume.

The company also recorded its highest ever monthly domestic sales of 171,941 units, while pure domestic dispatches for passenger vehicle buyers were 1,68,047. Exports stood at 21,951 units. Its market share also went up to 43.0%.

Hyundai

Hyundai is widening the gap with its core competitor, the Tata, in the month of October. The OEM managed to register a growth of 14.85% compared to October 2022 and a MoM growth of 1.6%. Hyundai’s Exter has given the OEM considerable demand in the festival season.

Tata Motors

Tata Motors YoY growth was 6.9% and its MoM growth was 7.9%, but its market share has gone down by more than one percent. Although the sales figures are commendable for the month of October 2023, the competition still holds its ground against Tata’s newly launched Harrier and Safari.

Mahindra and Mahindra

M&M registered the third consecutive highest sales for the month of October, and the OEM has come very close to Tata Motors. The market share of Mahindra has also increased by 1.6% compared to last year’s.

Kia Motors

Last month, Kia was in the 6th spot, but in the month of October 2023, it has regained the 5th spot, beating Toyota by a good 4000 units. The newly updated Seltos has delivered the required thrust to Kia’s sales, while the Sonet facelift, which is expected to come in the coming months, will push Kia’s sales even higher.

Toyota

Toyota’s YoY growth was massive, at 56.3%, which shows the faith of buyers in the brand. The OEM had to expand its production capacity to meet the growing demands.

Honda

Honda's sales seem to be following a threshold pattern even with the Elevate being added to their portfolio. The last month's growth was good in both YoY and MoM comparisons, but October sales didn't grow with the same enthusiasm. It may be the remaining part of the festive season that helps Honda cross the 10,000-unit mark.

MG Motors

MG registered both YoY and MoM growth of about 17% and 2%, respectively, helped by festive demand and price reductions in the past.

Skoda and VW

The Skoda and VW groups are doing well, and both have registered growth in annual and monthly comparisons. But there is nearly zero increment in their market share compared to last month.

Renault, Nissan, Citroen, and Jeep

I have categorized these OEMs into one group because all of them have registered an annual degrowth of more than 15%, with Jeep leading the charts with a massive negative growth of 55%. On the other hand, Citroen registered even a MoM degrowth of 15%, while others did fairly well in MoM performance.

| Previous News | Next News |

Hero MotoCorp will showcase an ADV scooter at EICMA 2023. Hero MotoCorp will showcase an ADV scooter at EICMA 2023. |

Royal Enfield’s new EV platforms are under development. To be revealed at EICMA 2023.

Royal Enfield’s new EV platforms are under development. To be revealed at EICMA 2023. |